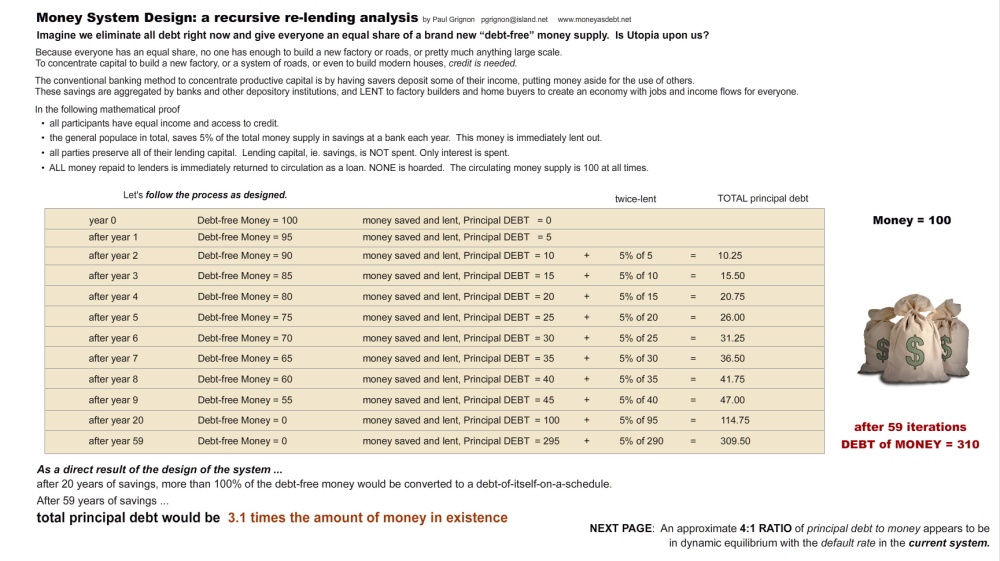

The following logical exercise demonstrates how so-called “debt-free” sovereign fiat money reverts to money-as-debt as the inevitable result of “100% reserve” lending.

The sovereignty of government to create money is not questioned,

nor are the good intentions of sovereign money reformers.

What is being demonstrated below is the futility of such reform.

click image to enlarge NEXT PAGE

Trying to follow your logic. I think, as is often the case in these discussions, people use the same words but with different definitions. In particular, the identification of money AS debt is very different than money TO SETTLE debt. As long as these distinctions are not made you and Joe and Steve will continue to dance in circles. Huber eloquently and precisely makes this distinction between an obligation (his meaning of “debt”) and the means of satisfying that obligation (money). Looked at it that way, the obligations we make to each other are of course infinite, only limited by our ability to produce goods and services. The amount of tokens needed to signify the end of an obligation can be finite as they circulate through the economy performing the function of setting the debt-records straight. You are free to use whatever definition of money you wish, but don’t expect a constructive discussion if the other parties are using a different definition – that is unscientific.

Looking at your page 1 example, I question why you restrict the supply of money to 100. Sovereign money advocates do not presume the money supply is fixed and is expandable just as it its to day with bank-created money.

LikeLike

Huber’s comment fails to distinguish “debt in general” from “principal debt to a bank” thus CREATING misunderstanding.

Money is someone’s principal debt to a bank usually on a schedule. Thus principal debt to banks and “money” are currently synonymous terms.

There is no disconnection when the principal debt to a bank is spent, making the debt into “money” as Joe Bongiovanni insists. Nor do savers in the aggregate spend their savings on time for the borrowers to be able to obtain the money they need debt-free as Steve Keen insists they do. Both arguments are logically absurd and directly CONTRADICT the evidence I put before them.

Everyone I have challenged ducks out at the same point, including the Bank of England’s Monetary Analysis Directorate whose 2014 confessional “Money Creation in the Modern Economy” conveniently omitted bank savings and the re-lending of principal debt to banks by non-banks. Why? Because if the truth be admitted, ALL loans are impossible contracts in the aggregate. An impossible contact is an invalid one. Anyone knowingly issuing an impossible contact is guilty of fraud. See my essay “Digging Deeper into Debt Money”.

As for page 1 it is a mental exercise showing how the system of aggregating savings to concentrate productive capital has linear rather than circular math. Linear math requires, that in order to avoid mass default, there must be constant growth of the money supply in proportion to the amount that goes into bank savings or is re-lent as existing money by non-banks. Sovereign money advocates fail to see this entirely and think money supply should be proportional to GDP. It is shallow thinking and mistaken.

So let’s add an endless supply of new money to the system on page 1 as you suggest. Now you must have endless real economic growth to prevent it from devaluing to nothing. Can we sustain endless economic growth on a finite planet? Economists are trained to think so. I and most others see it as a recipe for extinction.

So, to maintain a stable money supply in a stable sustainable economy, the government must tax back on a schedule every dollar it creates Thus sovereign money also comes into existence as debt, tax debt to the government on a schedule. Sovereign money is Money as Debt just like bank credit.

Now deposit it at a bank which replaces it or lends it out privately. Add up the debt: P of money < 2P of debt

Now deposit the borrowed money at a bank or lend it out privately again P of money < 3P of debt

And so on…

How many times can a sovereign debt-money dollar, lent as a mortgage, be saved and re-lent over its term of existence? As many times as bank credit can.

The Fed's own statistics clearly show that number to be: in boom times 3; in struggling times 4; and at the Crash of 2008, 5.26 just within the banking system. Just divide M2 by M1. It is so simple. Keen called it "silly arithmetic" but couldn't prove anything silly about it, whereas his assumption that all savings become available to the borrowers that created the money is patently absurd and in direct contradiction to logic and the evidence.

Non-bank lending of already existing bank created debt-money is estimated to be bigger than money creation. Thus the real number is probably closer to 10 or more times over. Every dollar in existence is simultaneously owed as principal debt to 10 or more lenders. Sovereign money reformers, bankers and economists remain oblivious to the inevitable consequences. The latter have a iron clad paycheck motive to remain that way.

Sovereign money reformers should wake up. The real reform needs to be the alternate form of money that the bankers would rather we forget forever: a time-limited promise of something specific from someone specific which is CIRCULAR MATH. Money as Debt 3 and my entire website are devoted to describing the how and the why.

LikeLike

Well, I will continue to explore your website but I fear there are semantic issues involved as well. While I have to reread your post it seems you may be inferring more than what Joe and Steve were espousing (Not sure Steve is a sovereign money proponent). I get that the amount of money in the system required to settle debt obligations may not be necessarily in proportion to GDP – depends on the velocity those tokens flow through the economy. On the other hand, if money is constantly sucked into non-productive casino speculation, the money creators will have to make up for that. I see the GDP guideline as a modifiable placeholder – a starting point for a monetary policy. Monetary reformers such as Huber are keenly aware of shadow banking and money market funds and feel they present a concern to be regulated regardless of a bank money or sovereign money system.

Since I have not seen the discussion its hard to see what the specific objections are on both sides.

LikeLike

Watched your video. While I feel an affinity for your sentiments, I feel you have set up some some straw men and have mischaracterized many proponents of sovereign money. Sovereign money certainly does not imply constant growth. And “growth” must be defined before you can invoke it. Growth can mean the runaway consumerism we see today or it can mean instead efficient use of resources for a thriving society and economy.

As confidence grows in a reformed economy, the need to draw money out of M1 into M2 will diminish. People won’t have to put away $1M in M2 just to survive in retirement – so why do it and deprive oneself of current well being? The expansion of M2 doesn’t seem mysterious at all – it is the depletion of money from the active economy for speculation and insecurity over the future.

Your statement that “flow multiplies stock” doesn’t make sense to me from a systems point of view. Flow transfers stock unless one has an open system to provide an exogenous flow.

When you assert “Money as debt” you are making a definition – which is fine. Huber has his definition of debt as well. We can choose to have dueling definitions or try to come to some common understanding of reality.

I will explore your producer credit concepts but I have a hunch it may be just a different formulation of the concepts proposed by sovereign money reformers. You may be creating a false enemy.

LikeLike

The fundamental difference is that “money” can be:

1. a single uniform quantity made valuable by its scarcity eg. cowrie shells, gold, silver, fiat money, bank credit , Bitcoin and all its imitators; or

2. an unspecified promise from an unspecified supplier eg. LETS, any mutual credit system; or

3. a promise of something specific from a specific supplier. eg. barter, capacity, or common tender credits (already estimated to be 20% of all world trade B2B). I call them Producer Credits.

Google this: Capacity Trade and Credit: Emerging Architectures for Commerce and Money

for a very educational read.

My little movie Credits (3 kinds) is 6 min.

http://paulgrignon.netfirms.com/MoneyasDebt/MAD2016/credits.htm

Government created money in my proposal is type 2 rather than type 1 as sovereign money proponents advocate. In my proposal, all governments have the right to spend credits that they later tax back, thus paying for all public services with a balanced budget at all times. This eliminates paying interest to private entities completely. However, to call it debt-free money as sovereign money advocates always do is fraudulent. It is interest-free money. That is significant enough!!!

Private issuers of trade credits do pay “interest” (in goods and/or services ONLY) to the customer that redeems the credit for services or goods. This is because private issuers can’t enforce tax collection on a deadline like governments can. Producers need to offer an incentive for the holder to redeem the credits when the Producer plans for them to be redeemed.

“flow multiplies stock” ? I have a $20 bill in my hand. How many times has this $20 bill changed hands before I got it? How many times will it change hands after? The same goes for purely digital money.

This point becomes relevant when people go off on this fallacy about the interest can’t be paid because it wasn’t created.

LikeLike

I agree with pslebow, Paul. I’ve come across this same view before from others steeped in bookkeeping. Perhaps the 2 videos of Jamie Walton of AMI describing the transition from private to sovereign money (ala the NEED Act) would address your concerns. Have you seen these? https://www.youtube.com/watch?v=pxFxSYXrkm0&t=26s & https://www.youtube.com/watch?v=tdU_Wm0vZ0E

LikeLike

Yes, and almost a decade ago I invited Stephen Zarlenga to examine the issues I bring up. Stephen appointed Jamie to do that. Jamie bailed on me right away, complaining that it was too hard to think about. Stephen invited me to speak at AMI but retracted the invitation immediately when I told him I would be critiquing their proposals as explained in those videos. Get the picture? “We don’t think very deeply and we don’t want to. We have a BELIEF.” That is the sovereign money movement, the blind leading the blind.

LikeLike

I think its unfortunate that you were denied the ability to take part in the conversation – I believe healthy criticism makes one stronger. I am completely unaware of the circumstances. On the other hand, are you partaking in the “we have a BELIEF” syndrome as well?

The “producer credit” concept is not as understandable as you presume. The lawn mowing analogy makes no sense to me – there are many unredeemable efforts that only have meaning to the initial IOU exchange – the circle will never complete. Cartoon was fun though. Maybe you can give some practical examples.

A “stock” is an accumulation. Doesn’t matter how many times a $20 bill changes hands, flows – the stock can never accumulate if it is leaving as soon as it enters someone’s possession. We seem to have another semantic issue here.

I don’t believe interest is the issue if that “fee” is commiserate with value added by the lender. On the other hand, when banks, who are the only ones allowed to create money as their “product” with no effort beyond underwriting, and then profit grossly from that minimal effort – that is immoral and destructive. For non-banks and individuals, whether interest should be charged for the lender’s deferring use of his or her money can be debated. But the distinction in this case is that it is “his or her” money obtained as a result of true value added by the lender’s efforts. Not so for banks.

LikeLike